Petrodollar Cracks: Saudi Arabia Considers Accepting Yuan For Chinese Oil Sales BY TYLER DURDEN for Zero Hedge

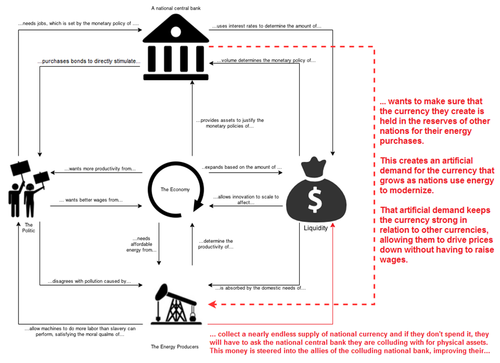

One of the core staples of the past 40 years, and an anchor propping up the dollar’s reserve status, was a global financial system based on the petrodollar – this was a world in which oil producers would sell their product to the US (and the rest of the world) for dollars, which they would then recycle the proceeds in dollar-denominated assets and while investing in dollar-denominated markets, explicitly prop up the USD as the world reserve currency, and in the process backstop the standing of the US as the world’s undisputed financial superpower.

Those days are coming to an end.

One day after we reported that the “UK is asking Saudis for more oil even as MBS invites Xi Jinping to Riyadh to strengthen ties“, the WSJ is out with a blockbuster report, noting that “Saudi Arabia is in active talks with Beijing to price its some of its oil sales to China in yuan,” a move that could cripple not only the petrodollar’s dominance of the global petroleum market – something which Zoltan Pozsar predicted in his last note – and mark another shift by the world’s top crude exporter toward Asia, but also a move aimed squarely at the heart of the US financial system which has taken advantage of the dollar’s reserve status by printing as much dollars as needed to fund government spending for the past decade.

According to the report, the talks with China over yuan-priced oil contracts have been off and on for six years but have accelerated this year as the Saudis have grown increasingly unhappy with decades-old U.S. security commitments to defend the kingdom.

The Saudis are angry over the U.S.’s lack of support for their intervention in the Yemen civil war, and over the Biden administration’s attempt to strike a deal with Iran over its nuclear program. Saudi officials have said they were shocked by the precipitous U.S. withdrawal from Afghanistan last year.

China buys more than 25% of the oil that Saudi Arabia exports, and if priced in yuan, those sales would boost the standing of China’s currency, and set the Chinese currency on a path to becoming a global petroyuan reserve currency.

As even the WSJ admits, a shift to a (petro)yuan system, “would be a profound shift for Saudi Arabia to price even some of its roughly 6.2 million barrels of day of crude exports in anything other than dollars” as the majority of global oil sales—around 80%—are done in dollars, and the Saudis have traded oil exclusively in dollars since 1974, in a deal with the Nixon administration that included security guarantees for the kingdom. It appears that the Saudis no longer care much about US “security guarantees” and instead are switching their allegiance to China.

As a reminder, back in March 2018, China introduced yuan-priced oil contracts as part of its efforts to make its currency tradable across the world, but they haven’t made a dent in the dollar’s dominance of the oil market, largely because the USD remained the currency of choice for oil exporters. But, as Pozsar also noted recently, for China the use of dollars has become a hazard highlighted by U.S. sanctions on Iran over its nuclear program and on Russia in response to the Ukraine invasion.

Today’s historic transition is not exactly a surprise: China has been stepping up its courtship of the Saudi kingdom in recent years, helping Saudi Arabia build its own ballistic missiles, consulting on a nuclear program and investing in Crown Prince Mohammed bin Salman’s pet projects, such as Neom, a futuristic new city.