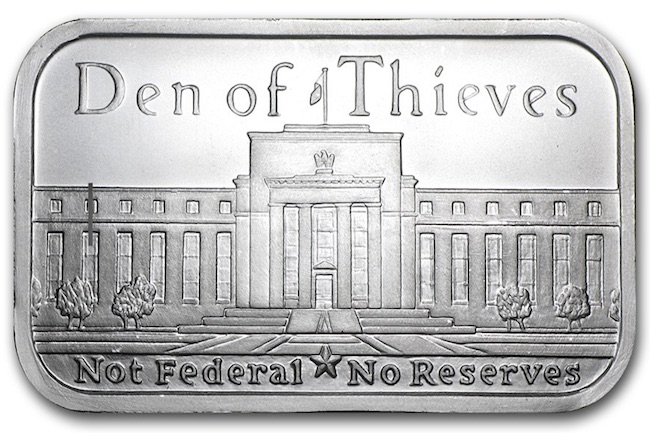

Is the Federal Reserve Merely Incompetent or Is There a Dark Agenda?

Paul Craig Roberts

I have never known the Federal Reserve make a good decision. Indeed, disastrous decisions are the Fed’s hallmark. There are many such disasters. Among them the Great Depression, the decade long consequence of the Federal Reserve Board’s failure to prevent the shrinkage of the US money supply. See: https://www.hoover.org/research/feds-depression-and-birth-new-deal

In more recent times we had Brooksley Born, head of the Commodities Futures Trading Commission (CFTC), blocked from regulating over the counter derivatives and credit default swaps that resulted in financial panic and economic collapse. Fed Chairman Alan Greenspan, Treasury Secretary Robert Rubin, Deputy Treasury Secretary Larry Summers, and SEC Chairman Arthur Levitt conspired to have Congress block Brooksley Born from doing her job. The four dumbshit officials told Congress that “markets are self-regulating.” Greenspann when later questioned by Congress admitted that his ideology “had a flaw.” http://www.shoppbs.pbs.org/wgbh/pages/frontline/warning/interviews/born.html

The Fed has abandoned effective financial regulation and helped to kill the 1933 Glass-Steagall Act that had kept commercial and investment banking separate. It is ironic that it was the formerly progressive Democrat Party in the clutches of the Clintons that repealed the progressive Glass-Stegall Act in 1999, thus setting up the line of financial troubles that caused the Fed to pump out money for 12 years in an effort to stabilize the financial system. Gretchen Morgenson and Joshua Rosner’s 2011 book, Reckless Endangerment documents the failure of financial regulation. Michael Lewis’s books, such as Flash Boys (2014), among others, demonstrate that the financial sector no longer serves any public purpose. All the years while the Fed was printing money hand over fist to keep the financial system intact, Wall Street was making its money by front-running stock purchases.

In 1890 monopolies were regarded as restraints on trade and efforts were made to prevent them with the passage of the Sherman Anti-Trust Act, followed by the passage of two subsequent anti-trust acts. Enforcement was spotty and the act was not always well applied, but monopoly was recognized as undesirable. Today that is not the case. Globalization produced the view that only large corporations and banks could compete on a global basis. Consequently, the Sherman Anti-Trust Act became a dead letter law. US monopolization of finance became an important foundation of US world hegemony.