Searches For “Real Estate Market Crash” Highest In Internet History BY TYLER DURDEN for Zero Hedge

GNN Note – While we want to move a little further away from the city, we are concerned about what is happening with the market. Where we are located the market is absolutely changing, on a weekly basis, and this cause for patience on my part. / END

Another milestone for the extremely confused elderly citizen in the White House basement.

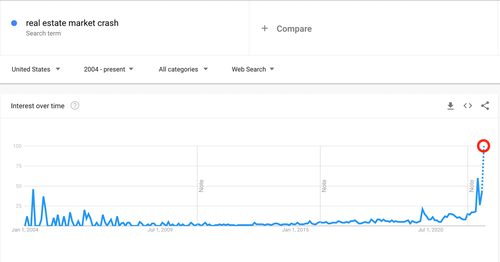

Analysis of Google Trends data reveals that searches for ‘real estate market crash’ exploded 284% in the United States as of September 2022 – the highest level in Google Trends history.

The analysis by the Malibu real estate experts at RubyHome reveals that search interest for ‘real estate market crash’ exploded within the past month, an unprecedented increase in Americans looking for information and prognostication about the real estate market, according to Google search data.

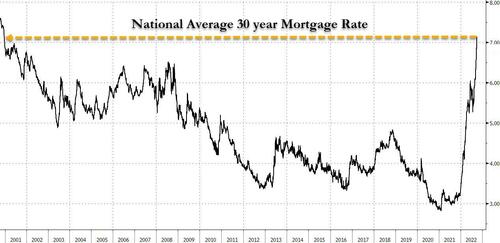

This comes at a time when the US housing market sees mortgage rates rising at the fastest pace in history, surging above 7% after touching 6% just two weeks ago!

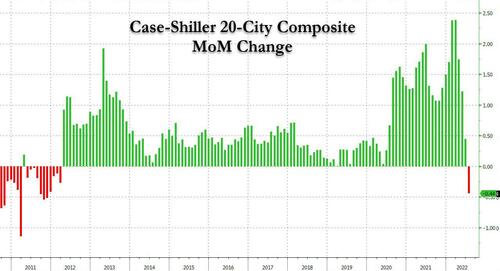

Pointing out the obvious, RubyHome CEO Tony Mariotti said that “we know home sales are down. Tuesday’s report from Case-Shiller confirmed the broad price reductions, which also showed U.S. home prices continued their deceleration in July at their fastest rate in the history of the index. We’re keeping an eye on this because market activity is seasonally low – we’ll know a heck of a lot more about how soft the market is come next spring.”

“Mortgage rates continue to rise beyond the Federal Reserve’s reported 6.29% on September 22. However, we’ve seen this accelerate; mortgage approvals on 30-year fixed loans this week reached 7% for some of our buyers. Going forward, if this trend holds, buyers will afford smaller homes unless they are cash buyers.”

“Sellers who’ve been holding out for pandemic-inflated prices are going to have to eventually lower their prices. This is just a psychological shift taking place – one that takes a few months to play out.”