US Inflation: Which Categories Have Been Hit Hardest? BY TYLER DURDEN for Zero Hedge

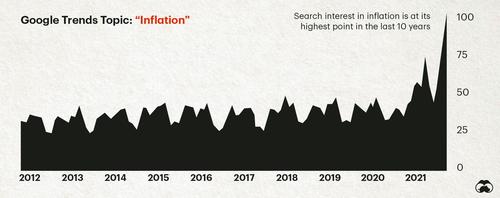

Prices have been going up in a number of segments of the economy in recent months, and, as Visual Capitalist’s Nick Routley exposes below, the public is taking notice. One indicator of this is that search interest for the term “inflation” is higher than at any point in the past decade.

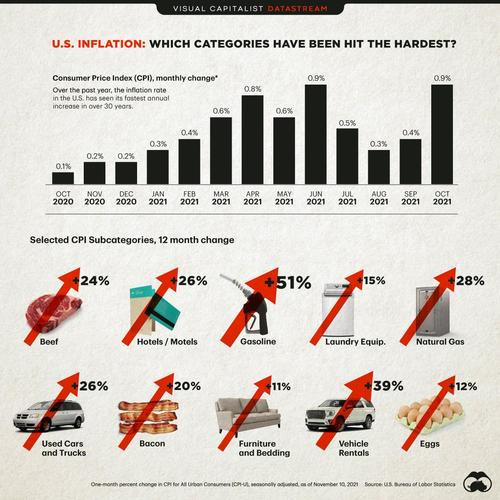

Recent data from the Bureau of Labor Statistics highlights rising costs across the board, and shows that specific sectors are experiencing rapid price increases this year.

Where is Inflation Hitting the Hardest?

Since 1996, the Federal Reserve has oriented its monetary policy around maintaining 2% inflation annually. For the most part, U.S. inflation over the past couple of decades has typically hovered within a percentage point or two of that target.

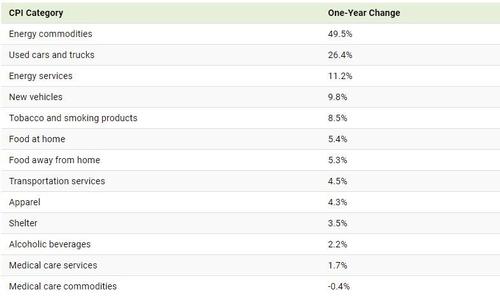

Right now, most price categories are exceeding that, some quite dramatically. Here’s how various categories of consumer spending have fared over the past 12 months:

Of these top-level categories, fuel and transportation have clearly been the hardest hit.

Drilling further into the data reveals more nuanced stories as well. Below, we zoom in on five areas of consumer spending that are particularly hard-hit, how much prices have increased over the past year, and why prices are rising so fast:

1. Gasoline (+50%)

Consumers are reeling as prices at the gas pump are up more than a dollar per gallon over the previous year.

Simply put, rising demand and constrained global supply are resulting in higher prices. Even as prices have risen, U.S. oil production has seen a slow rebound from the pandemic, as American oil companies are wary of oversupplying the market.

Meanwhile, President Biden has identified inflation as a “top priority”, but there are limited tools at the government’s disposal to curb rising prices. For now, Biden has urged the Federal Trade Commission to examine what role energy companies are playing in rising gas prices.

2. Natural Gas (+28%)

Natural gas prices have risen for similar reasons as gasoline. Supply is slow to come back online, and oil and natural gas production in the Gulf of Mexico was adversely affected by Hurricane Ida in September.