Inflation Flying in Hotter than Ever! by David Haggith for The Great Recession

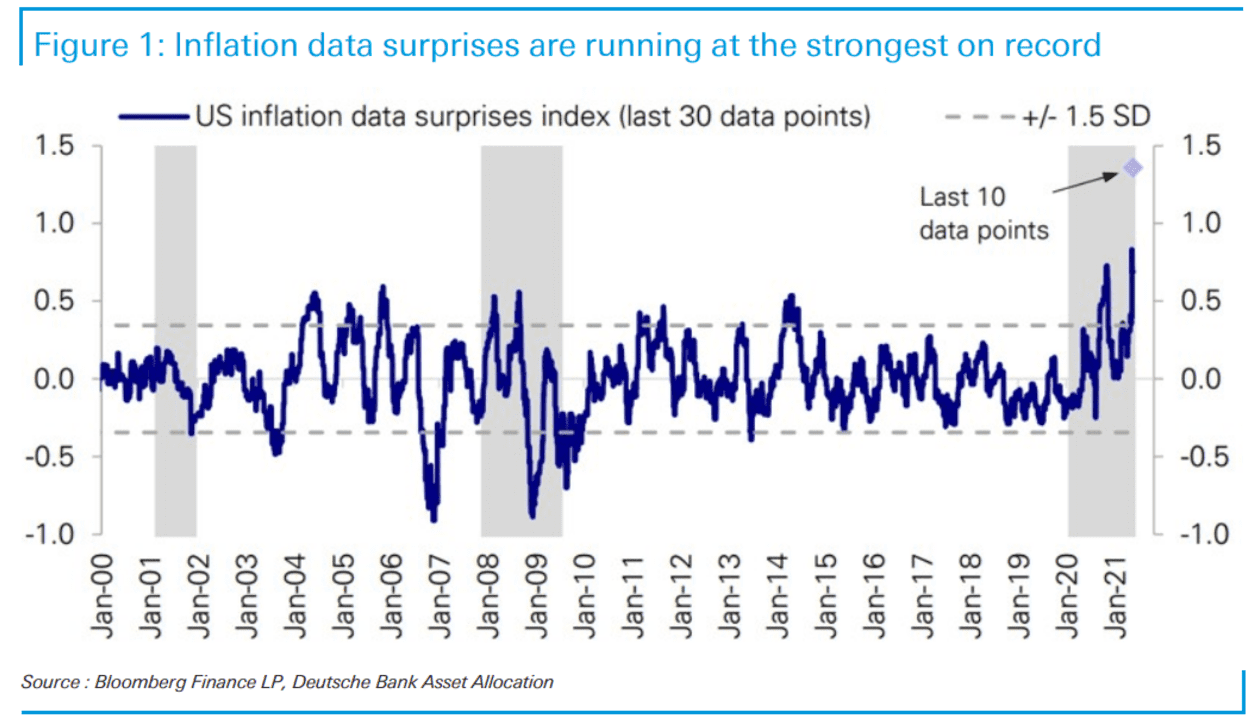

All those economists who went along with the Fed’s inflation-is-temporary-and-going-per-plan narrative are stunned by the data they now see coming in. They shouldn’t be, as it was predicable. However, they will need to get bigger charts to make room for it. Notice where the last ten data points for the increase in inflationary surprises are located (look up to the far, top right corner of the chart):

The chart shows U.S. inflation data surprises at their highest in the 20-year history of the series, said strategist Jim Reid, referring to a note by equity strategist Parag Thatte. The last 10 data points were “almost off the chart,” he noted.

So much for the high inflation print in April being due to “base effects.” The surprise index reveals whether inflationary data is higher or lower than economist expected. It’s hard to claim that the base effect from last year’s COVIDcrisis resulted in more surprises to economists, given those economists were all trying to claim inflation was going to rise due to a base effect before April’s hot print. How can you surprise experts who are expecting the base effect when every one of them knows exactly where the base was last year? If you’re going to claim an effect due to the base — the starting point — there is no surprise at what that starting point was … only at where you ended up.

Comparisons with year-ago price levels depressed due to the pandemic — were also anticipated to spur a run of hot inflation numbers. Those were all among reasons the Federal Reserve had assured it would look at rising inflation as “transitory,” or likely to fade.

A “surprise,” however, means inflation flew in well above the expected “base effect!”

Support Our Site

Now is your chance to support Gospel News Network.

We love helping others and believe that’s one of the reasons we are chosen as Ambassadors of the Kingdom, to serve God’s children. We look to the Greatest Commandment as our Powering force.

Reid wrote, “these were surely all known about before the last several data prints and could have been factored into forecasts. That they weren’t suggests that the transitory forces are more powerful than economists imagined or that there is more widespread inflation than they previously believed.”

First of all, prices a year ago were not depressed. They just didn’t rise much, so any talk of the base effect is meaningless. April’s 4.2% rise YoY is still a 4.2% rise in one year, regardless of what the year before did. It’s not like inflation has a mind to say, “Oh, I need to make up for last year.” It is what it is.

Stock market coughs up a hairball

Once again, we saw the market choking today on this news, turning from green to red with the S&P rebounding, again, off its 45-day ceiling of 4200. It keeps pounding its head against that barrier but not really busting through because inflation concerns keep grabbing its butt like a junkyard dog pulling someone down off the fence he’s trying to scale.