Bad Bankers Are How Big Business Beats Small Business, But Congress Can Fix It By Christopher Bedford for The Federalist

GNN Note – Time to wake up. Faith without works is DEAD. If you want to remain DEAD then keep sitting there doing nothing, saying nothing and feasting on the crumbs your owners sweep off the table.

******

There are reasons major companies got massive loans from the Senate’s ‘small business’ bailout while thousands of small businesses that applied immediately were told there was no money left.

There are reasons major companies got massive loans from the Senate’s “small business” bailout while thousands of small businesses that applied the first day funds were available were told there was no money left. Who is to blame, however, is more complicated.

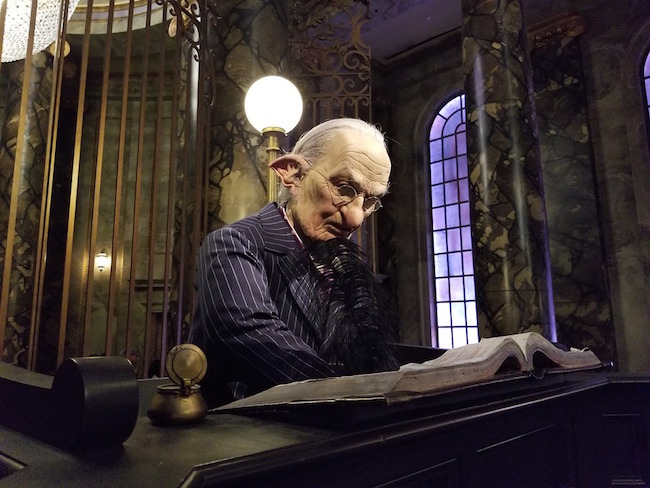

Imagine bankers who won’t deliver you taxpayer assistance unless you already owe them money. Imagine bankers who will put you at the back of the line so that franchises worth hundreds of millions or even a billion dollars can get the aid first. Imagine a law our leaders passed allowing all of this. Now understand that what you’ve just imagined appears to be exactly what has happened.

The federal coronavirus bailout has first-come-first-serve rules that kick in once a bank sends a loan application to the government’s Small Business Administration (SBA), but in the interest of speed amid a crumbling economy and under an intense lobbying campaign from corporate interests, the end text of the law was vague at best on how banks are required to treat applicants before sending their requests to the SBA. Because of this, banks that wish to are able to pick winners and losers based on their own incentives, such as previous relationships, existing debts, or simply the potential to earn a profit.

A series of class-action lawsuits filed Sunday in Los Angeles allege that four banks — Wells Fargo, Bank of America, JPMorgan Chase, and US Bancorp — rushed loans to the biggest businesses to maximize their earnings. “In the last three days of [the Paycheck Protection Program],” or just when funds began to run low, the lawsuits notes, “banks processed loan applications for $150,000 and under at twice the rate of larger loans.” According to the plaintiffs, this indicates that the larger loans had been pushed to the front of the line.

But why would it matter? The answer is not all loans are equal. Banks, the suits explain, earned “5 percent on loans of up to $350,000; 3 percent on loans between 350,000 and $2 million; and 1 percent on loans between $2 million and $10 million” — or up to $17,500 for the smallest set, and up to $100,000 for the larger set.

The bankers claim they’re innocent, and that the appearance of different treatment is simply the result of different divisions working at different speeds with different client loads. The end results, however don’t look pretty at a time Americans are struggling and businesses are shutting their doors forever.