The Dark Secrets in the Fed’s Last Wall Street Bailout Are Getting a Devious Makeover in Today’s Bailout By Pam Martens and Russ Martens

GNN Note – If you think the banking crimes committed by the Federal Reserve, JPMorgan, CITI, Wells Fargo, Bank of America and several others were bad in 2008 – you ain’t seen nothing yet – I wouldn’t even classify those crimes as a warm up.

******

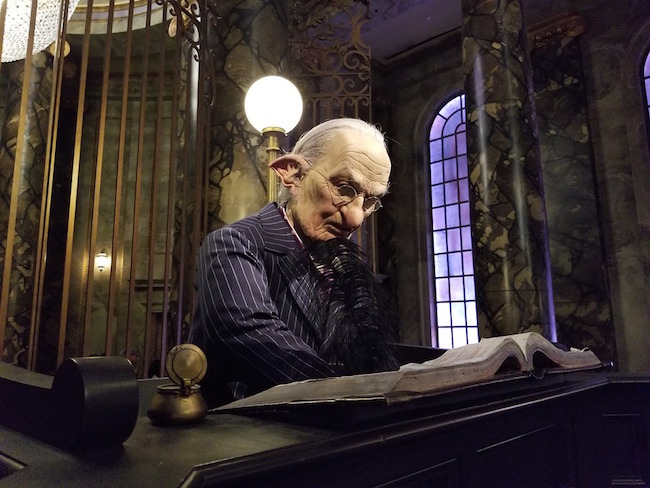

From December 2007 to November 10, 2011, the Federal Reserve, secretly and without the awareness of Congress, funneled $19.6 trillion in cumulative loans to bail out the trading houses on Wall Street. Just 14 global financial institutions received 83.9 percent of those loans or $16.41 trillion. (See chart above.) A number of those banks were insolvent at the time and did not, under the law, qualify for these Fed loans. Significant amounts of these loans were collateralized with junk bonds and stocks, at a time when both markets were in freefall. Under the law, the Fed is only allowed to make loans against “good” collateral.

Six of the institutions receiving massive loans from the Fed were not even U.S. banks but global foreign banks that had to be saved because they were heavily interconnected to the Wall Street banks through unregulated derivatives. If one financial institution in this daisy chain of derivativesfailed, it would set off a domino effect.

Another $10 trillion was spent by the Fed providing dollar swaps to foreign central banks, bringing the final tally of the bailout to $29 trillion. The Levy Economics Institute used the data that the Federal Reserve was forced to release through an amendment attached to the Dodd-Frank financial reform legislation in 2010 to compile the $29 trillion tab. Its figures are in line with the audit done by the Government Accountability Office (GAO), also mandated by the same amendment. The GAO auditincluded most, but not all, of the Fed programs, so its figures fall short of the comprehensive job done by the Levy Economics Institute.

There are two dark secrets about the Fed’s last bailout of Wall Street. First, the Federal Reserve Board in Washington, D.C., which is a federal agency with its Chairman and Board appointed by the President and confirmed by the U.S. Senate, outsourced the bailout to the Federal Reserve Bank of New York (New York Fed), which is a private institution owned by the Wall Street banks. The New York Fed, in turn, outsourced the management of the bailout to some of the very Wall Street firms that were receiving the funds. We know this from the details contained in the GAO audit. (See our “Vendor” section below.)