Pension Bailout Would Only Worsen Underfunding Crisis By Rachel Greszler for CNS News

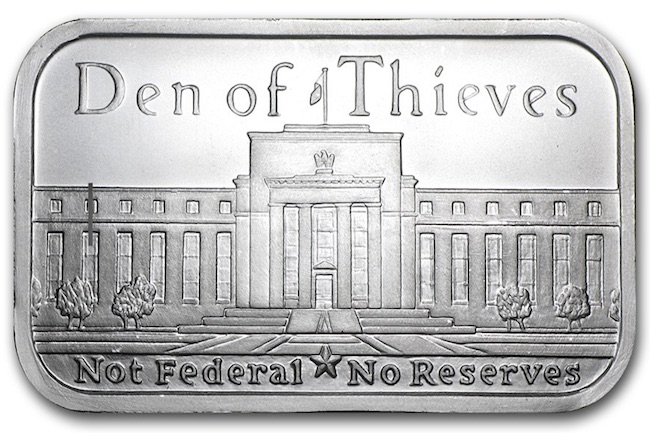

GNN Note – The author fails to see how the bail outs that went to the banks actually stripped the pensions around the country. Had the banks and various corporations never been bailed out in 2009 the pension programs would’ve suffered for 3-4 years but at this point would, not only be fully recovered, they would be prospering. Bailing out the pension programs – 100% of all – would be half of what was stolen during the 2009 bail out of the banking cabal.

******

A friend of mine recently had the unfortunate experience of dealing with multiple abscessed teeth in her children.

These abscesses occurred because a neglectful dentist had “treated” her kids’ cavities by concealing them with quick, painless fixes instead of drilling down and eliminating the root of the problem.

In the end, the kids had to undergo much more intense, expensive, and painful treatments than if their cavities had been properly treated to begin with.

The Congressional Budget Office has recently found that Congress’ so-called “solution” to a $638 billion multiemployer pension crisis would similarly exacerbate the situation—but without the benefit of Novocain.

On July 24, the House of Representatives passed H.R. 397, the Rehabilitation for Multiemployer Pensions Act. (The same day, a group of senators reintroduced a similar bill, the Butch Lewis Act, named after a well-known union and pension activist.)

The bill, or a similar pension bailout, could be tied to must-pass legislation this fall or early in 2020.

The bill by itself would cost taxpayers more than $100 billion, according to the Congressional Budget Office. The first component would contain about $35 billion in loan costs.

Under the bill, the Congressional Budget Office estimates that a new pension rehabilitation administration would provide $39.7 billion in loans, of which taxpayers would recoup only $7.4 billion in interest and loan repayments. That’s equivalent to a roughly 80% default rate.

In addition, already insolvent plans would receive $3.6 billion in loans that they likely could not repay.

The second component of the bill would consist of an estimated $71 billion in direct cash assistance, primarily through annual disbursements. The Congressional Budget Office estimated that the Central States Pension Fund would receive $3 billion in direct cash in 2020 alone.