Powell Admits in Congressional Testimony Inflation is Hotter and More Concerning than the Fed Expected by David Haggith for The Great Recession

When asked about where inflation is now and how it relates to how high the Fed thought inflation would reach and what the Fed’s targets for inflation really are, Powell made it clear that inflation is running much hotter than the Fed thought it would be and for longer:

This is not moderately above 2% by any stretch … This is wellabove 2% … and, of course, we’re not comfortable with that…. This inflation … is larger than we had expected or than anybody had expected…. To the extent it gets longer and longer, we’ll have to continue to re-evaluate the risks.

— Powell, from the video below

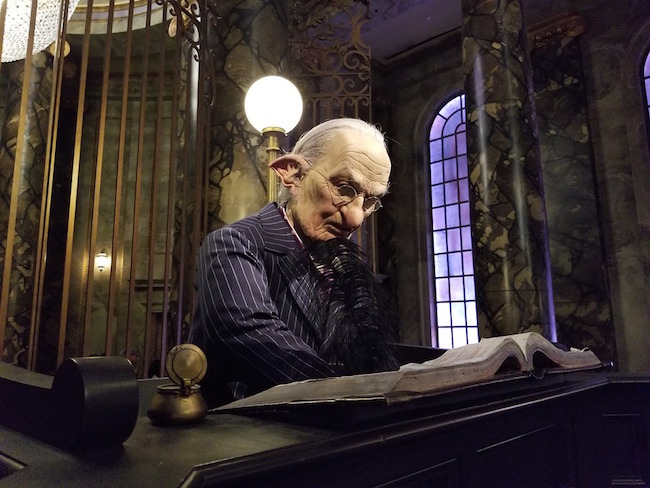

VIDEO

Powell also said in his congressional testimony, when asked what tools the Fed has to curb inflation if additional planned government spending takes inflation even higher, that the Fed’s tools are to raise interest rates and take money out of the economy. The Fed has been assuring congress for some time they have the tools they need. What they are not candid in saying is that they cannot use those limited tools without crashing the recovery.

Always the tools we have in financial policy is to raise interest rates [and] to tighten financial conditions more broadly … and that’s how you get control of inflation.… That’s what we’ll do when and as we need to.

(about 43 minutes into the video)

However, using those crude tools would crush stock and bond markets that have already shown themselves sensitive to taper talk. So, if inflation runs hotter for longer, the Fed will have to kill the recovery as the only means it has of wrestling inflation to the ground.

Powell even stated that the inflation we have today is unique in history and said candidly that the Fed isn’t sure how well it understands the current situation.

We’re humble about what we understand. We’re trying to understand both the base case and also the risks.

(about 44 minutes in)

If the Fed is willing to humbly admit before congress that it may not even understand the kind of inflation we are experiencing because it is without precedent, then let’s not be too ready to believe they have this under control when their only two tools to combat inflation are a skull-crushing club and a broad axe. As, I’ll lay out later in my own video interview below, even a delicate use of these tools could be catastrophic under our present equally unprecedented debt loads.

Assessing the Fed’s ability to understand today’s unique inflation, one congressman noted how Fed officials have created skepticism about their ability to see what is happening with inflation this year by repeatedly playing a game of catch-up-to reality, stepping up their underestimated inflation predictions much more slowly than inflation has been rising.